Europe and Southeast Asia (SEA) had a bad break up. The Philippines was under Spanish rule for over 300 years. Indonesia was under Dutch rule for over 100 years. Both Malaysia, and the breakaway sovereign state of Singapore, were under British rule also for over 100 years. The three countries of Laos, Cambodia and Vietnam (which was collectively known as French IndoChina) were under French rule for over 50 years. After World War 2, the decolonization process materialized gradually across SEA, but it was difficult and sometimes bloody. By 1984, the European powers had completely left.

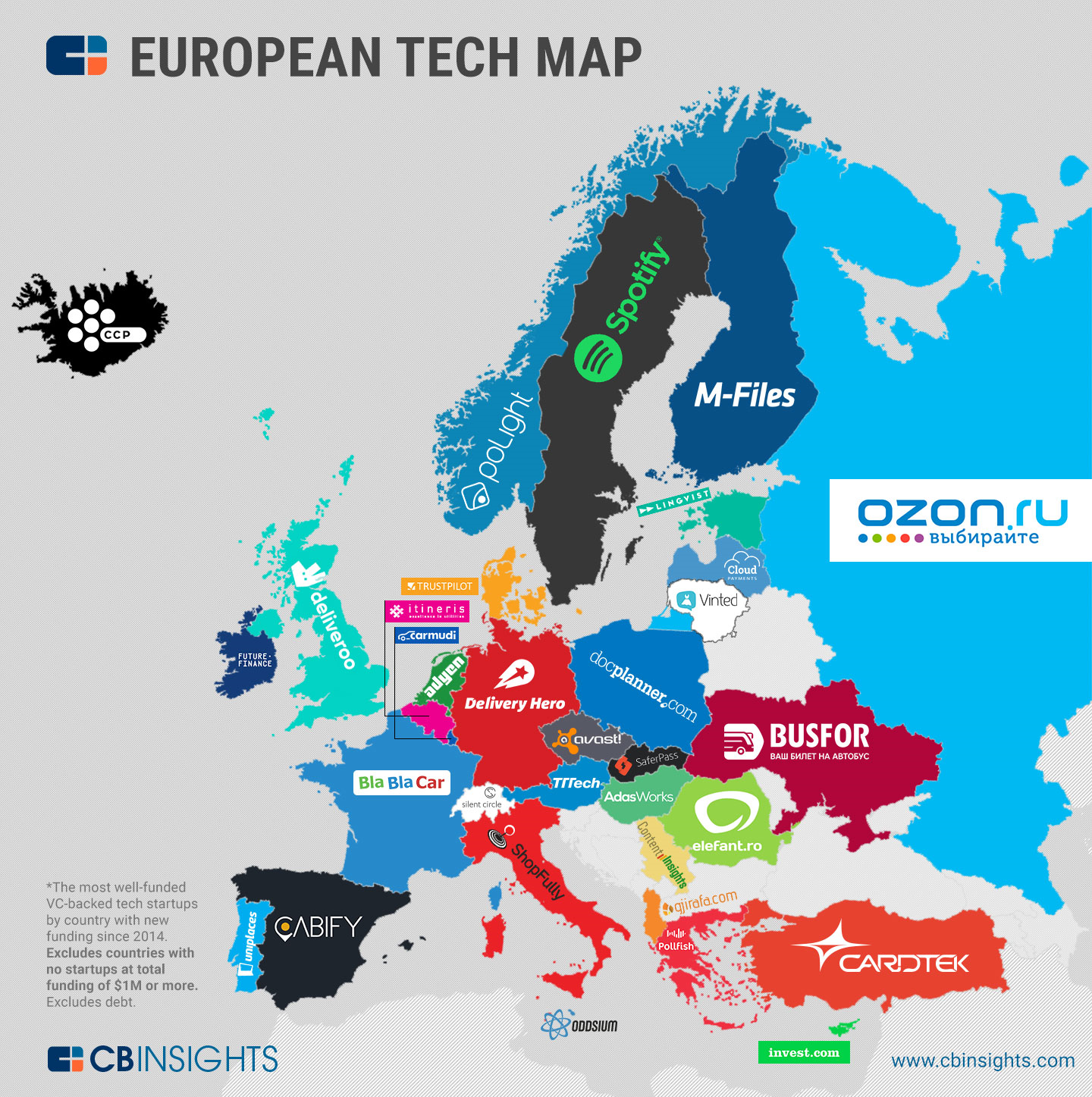

Over 30 years later, few will argue that SEA wants its ex-colonizers back. On the contrary, sovereignty and independence have allowed the many nations of SEA to thrive separately under a unique blend of local culture and the remnants of its history of colonization. As an economic bloc, the Association of Southeast Asian Nations (ASEAN) has been heating up (also discussed by Forbes here and by Jungle Ventures here) of late and its budding tech scene is starting to gather attention. With a digital population of 339M, SEA already has more people online than the entire population of the U.S. It’s upside is huge with a penetration rate of just 53% and year on year growth of 31%, according to a Hootsuite x We are Social report.

As the Director of Financing and Investments in a Multi-Family Office (read about MFOs in this post), I am responsible for developing investment theses and recommending fund deployment across various asset classes. Over the last 2 years, I have witnessed the rapid transformation of the startup ecosystems in SEA, creating a window of opportunity for pioneering tech investors. For the next few months, I will be traveling around Europe to do a deep dive into the various startup hubs and continue developing my investment thesis asserting a cross border play between Europe and SEA.

Invest now, but with caution

The three initial pillars of my thesis:

- Diamonds in the rough -First, I assert that funds need to enter SEA in the next 18 months to find some quick wins, understand the ecosystem, and build a track record. The innovators and first winners have emerged paving the way for a larger wave of early adopters. Meanwhile, there are just a handful of active Venture Capital funds (VCs) so there is much value to be found.

- A little too early for all in -Second, and more importantly, I offer a caveat for General Partners (GPs)- but more so for Limited Partners (LPs) (more on that later) – that an exclusively Southeast Asian tech play should wait at least 3 years; and, 5 years for a country specific play. If you intend to go all in, you should know that we’re still pre-flop.

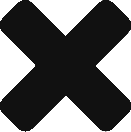

- Look West, but not too far -Finally, I assert that a cross border view is necessary in the interim and Europe should be the regional complement, instead of the more developed and more obvious U.S. market. Venture capital and the tech revolution may have originated from the U.S. but Europe’s various startup hubs are developing quickly with support from the European Union. More importantly, the market is much less saturated than the U.S.

Europe and Southeast Asia deserve one more chance, from a tech investment standpoint. This cross border tech play is worth consideration for any investor already present or looking to enter either of these markets.

First Winners

Since 2014, SEA has produced three startups valued over a billion dollars, contributing to the decade-long trend of global tech companies raising successive rounds of funding while remaining privately owned. While this number still pales compared to the 121 unicorns in the U.S., 66 in China, and 44 for the rest of the world, the trio of SEA Ltd. (formerly Garena), Grab (formerly GrabTaxi), and Go-jek have paved the way for the next wave of regional technopreneurs. The game-publisher-turned-consumer-platform SEA Ltd. (Singapore) is leading the pack, achieving unicorn status in 2015 and recently announcing its plan for a $1Billion U.S. IPO. Meanwhile, ride-hailing giants Grab (founded in Malaysia) and Go-jek (Indonesia) achieved unicorn status within 4 years and 2 years, respectively.

The other members of the Asean-5 have also had their fair share of winners. In 2014, mobile tech company Xurpas completed the first ever IPO by a tech company in the Philippines and its market capitalization reached a high of $720M. In 2015, fitness tracker producer Misfit Wearables, led by a Vietnamese CEO and engineering team, was acquired by Fossil for $260M. In 2016, e-commerce fulfillment company Acommerce raised a Series B shortly after a 20% investment by Switzerland-based DKSH, putting its estimated valuation at $50M, and making it one of the most valuable startups in Thailand.

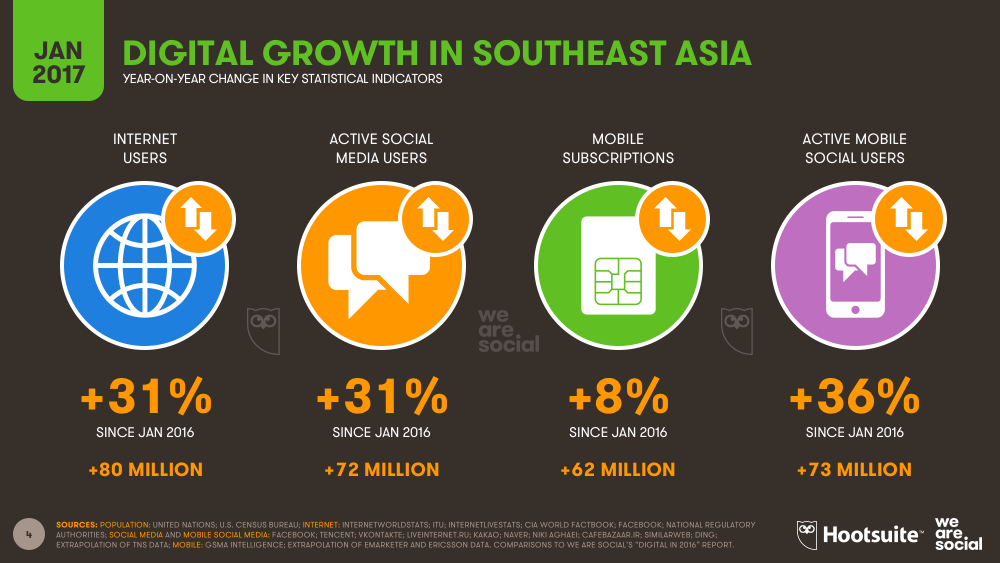

These first winners have emboldened the next wave of startup founders in the region. From 2012 to 2016, there was a four-fold increase in the number of early stage venture capital deals in SEA. Even better, these investments are translating into exits at a ratio that is better than more developed startup ecosystems. According to the Tech in Asia H22016 Venture Investment Report, SEA had an exit ratio of 7.8x, which indicates that the region requires a lower number of deals to produce exits than the top two highest funded venture capital markets of the U.S. and China with 10.4x and 40.0x, respectively.

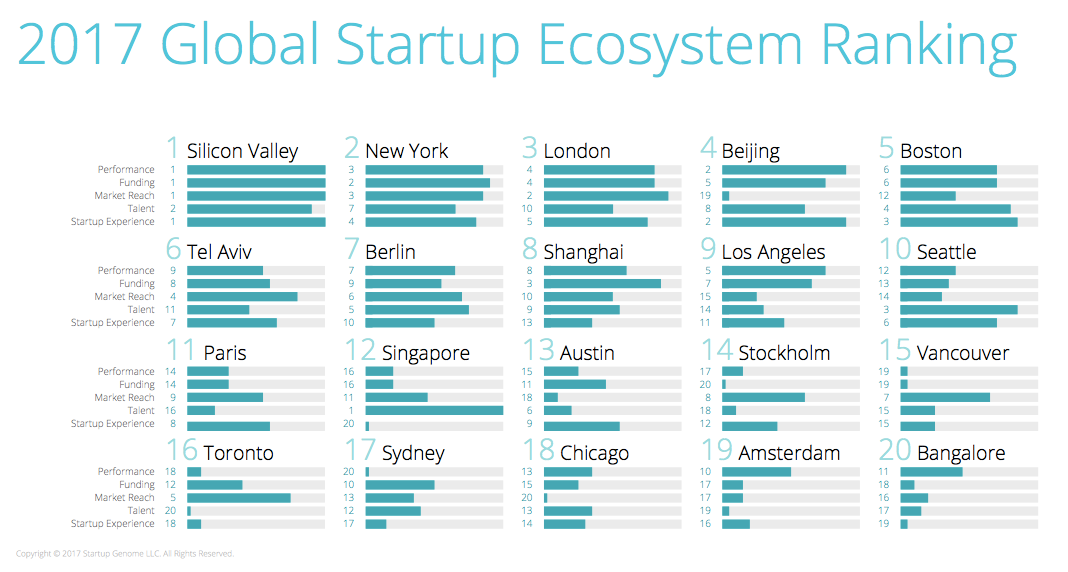

The region’s tech ecosystems are only expected to get stronger due to large english speaking populations, the abundance of talent, and lower costs of living. Of the top 15 countries with the highest English proficiency for non native speakers, only Singapore, Philippines, and Malaysia come from outside Europe. As the only first world economy in SEA and de-facto regional leader, Singapore is already the 2nd ranked talent hub globally, only trailing Moscow and faring even better than Silicon Valley, according to the Startup Genome Global Ecosystem Report 2017. While talent quality remains 10th overall, Singapore makes up for it with a high proportion of software engineers with two or more years experience as well as the ease and cost of hiring these engineers. Outside China and India, Singapore has the lowest average software engineer salary at $35k among the top 20 hubs.

A Caveat for LPs (and GPs too)

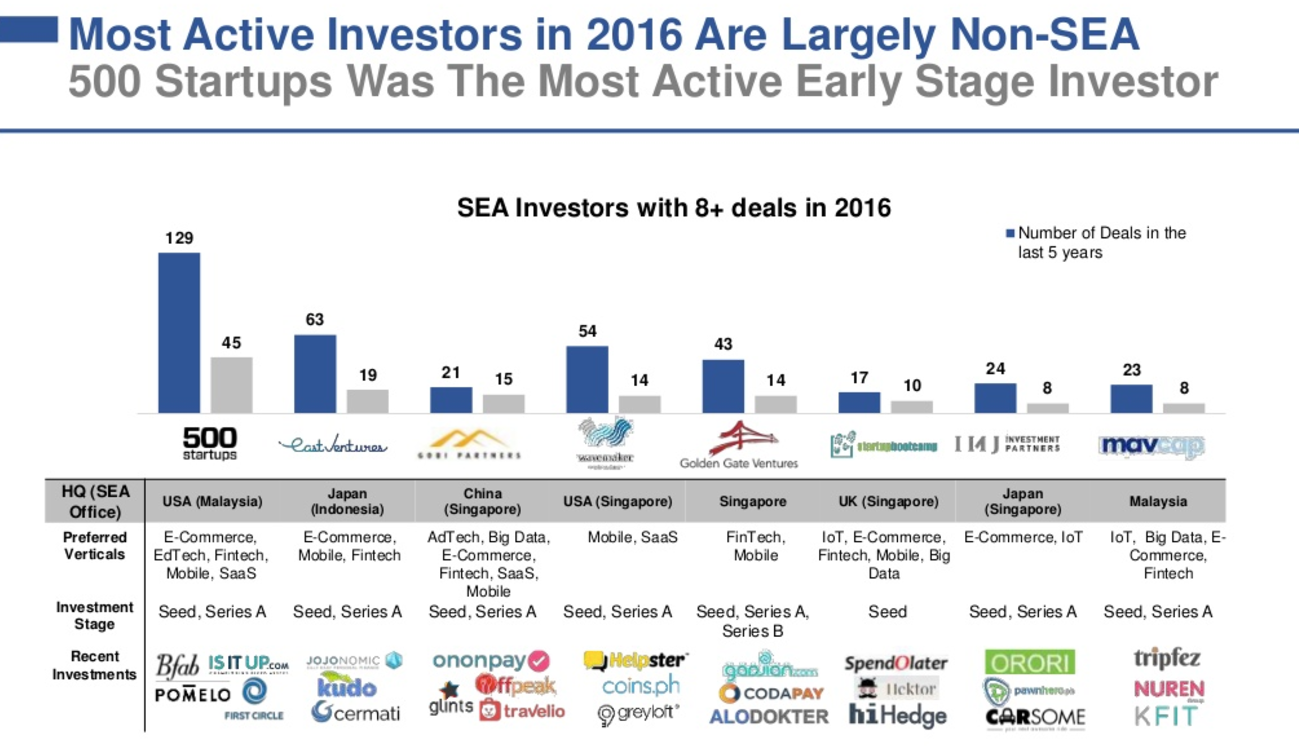

Some funds are paying attention. Last year, $2.2B of venture capital funding, across 274 deals, flowed into SEA from 110 investors, according to an Advento Feb 2017 report. However, $1.3B or 59.1% of the entire funding amount went to just two of its unicorns, Grab ($750M Series F) and Go-jek ($550M Series B). The same report reveals that there are only a handful of active investors in the region with 8 funds accounting for 133 deals or almost half the entire number. Of the 8 active funds, only Golden Gate Ventures and government-backed MavCap are regional funds. The rest are offshoots of VCs headquartered in developed markets.

The most encouraging indicator in SEA is the organic growth of the ecosystem. Serving as the initial funnel for startups, numerous incubators, accelerators, and venture builders have popped up across the region with 21 of them having done deals in the past year. Of these 21, only Seedstarsworld (Switzerland), 1776 (U.S.), and Wells Fargo (U.S.) don’t have global headquarters in Asia Pacific. Singapore, Malaysia, Philippines, Indonesia, and Thailand all had seed stage players that did deals in 2016.

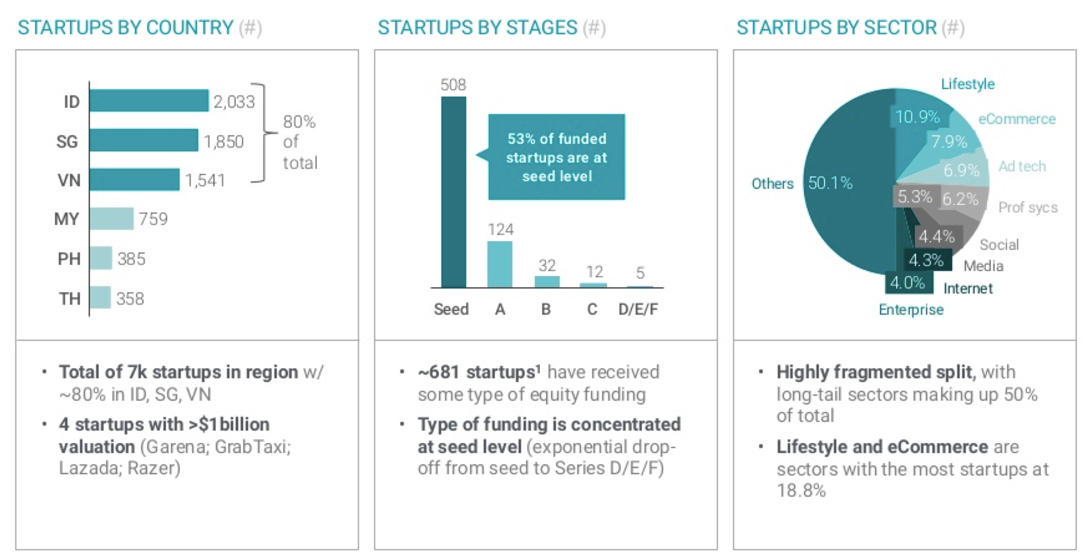

Yet, most GPs shy away from SEA because they know that the ecosystem is far from fully developed. Beyond seed stage funding, there’s a lack of growth capital funds and a larger shortage of exit options. With only 69 VC funds doing deals in SEA last year, it is a far cry from the 2,105 funds that invested in a U.S. based startup, of which 738 participated in a startup’s first round of institutional funding. The same report by the U.S. National Venture Capital Association (NVCA) indicated that there were 726 VC-backed exits in the U.S. in 2016 alone versus 11 tech IPOs and 127 M&A exits in SEA from 2005 to 2015.

Nonetheless, the pace and scale of exits in SEA are both rapidly growing with 17, 23, and 45 exits in 2013, 2014 and 2015, respectively; and, 8 of the top 10 largest exits coming in those 3 years. In 2016, SEA enjoyed a banner year because of the names that entered the market, spearheaded by Google and Alibaba. Marking Google’s first acquisition in SEA, SG-based communication platform Pie was acqui-hired by the tech giant in February last year to build its first engineering team in the region. A few months later, Alibaba made a bigger splash by paying $1B to acquire a controlling stake in e-commerce platform Lazada. Just last month, Alibaba topped up its investment in Lazada by another $1B to increase its stake to 83%. These exits to market dominant players from the 2 largest VC markets are sure to turn heads and pave the way for other VCs to enter the market.

At the moment, the VCs present in the region are predominantly cross border funds that look simultaneously at the U.S. and SEA. This cross border play is epitomized by 500 Startups, which is the most active VC in SEA with 45 deals in 2016 and a total of 129 deals over the last 5 years. Yet, it is headquartered in the U.S. and has invested in over 800 startups globally. The strategy makes sense because it offers a good mix of upside growth from an unsaturated market like SEA and shorter holding periods from the developed U.S. market. At the company level, this is a theoretically sound play for GPs.

At the fund level, it is still too risky for most LPs to invest in an exclusively Southeast Asian play for the next 3 years and a country specific play for the next 5 years. The projected timing is based on the median time between rounds in Asia, which is a little under a year and half for both seed to Series A and Series A to Series B. According to a Google x Temasek report, there are 681 are VC-backed (out of 7,000 total) startups in SEA and 53% of those are still at seed level. Within 3 years, there will be 2 more funding cycles and 2 new waves of early winners (or losers). Within 5 years, there should also be 1 or 2 funding cycles from trailblazing country specific funds. In that span of time, the ecosystems would have improved significantly and there would be substantially more growth capital and exit options.

Time will tell whether 500 Startups will thrive with its ultra aggressive strategy, launching a $20M 500 Durians Fund I in 2015 and a $50M 500 Durians Fund II in 2016, both of which invest solely in the region. In addition, they have launched $10M micro-funds for both Thailand and Vietnam, while a third one for the Philippines is being planned. It goes without saying that venture capital is at the far right of the risk-reward spectrum. For certain categories of investors like Ultra High Net Worth individuals, a promise of a substantial bump in returns might be the most important consideration. However, most LPs such as Family Offices, Large Corporations, Insurance Companies, and Pension Funds still have to exercise some prudence so investing in a cross border play is necessary to participate in the imminent tech boom in SEA.

A Tale of Two Giants: A Lumbering One and One Recently Slumbering

If too little money is a problem, too much money may be problematic as well. Such may be the case in the U.S. right now. In June 2017, US-based consumer electronics company Jawbone initiated liquidation proceedings after failing to achieve profitability with its fitness tracker despite raising over $900M of venture funding and hitting a peak valuation of $3.2B. As the 2nd largest failure among venture-backed companies, it is being referred to as a “death by overfunding,” since pundits have said that it could have been a suitable acquisition target if it kept its valuation lower by raising less venture capital.

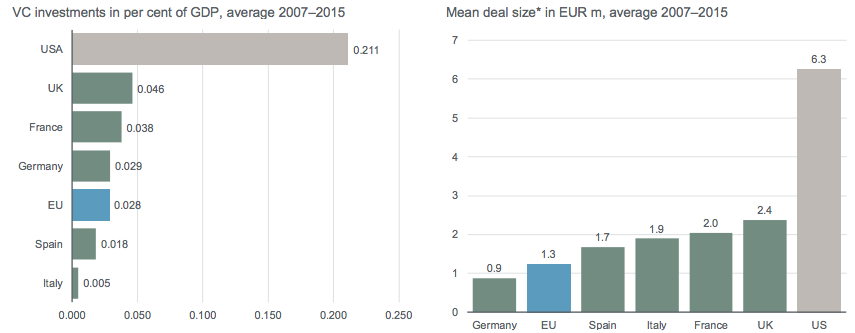

With so much money going after the same deals in the U.S., inflated valuations and high profile failures such as these are inevitable. Per NVCA, the U.S. had 253 new VC funds raising $41.6B in 2016, bringing the total number to 1,562 funds with AUM of $333.5B. In contrast, Europe only had 116 new VC funds raising €6.4B last year, according to Invest Europe. This brings the total AUM in Europe to €46.4B, when added to the €40B raised from 2007–2015 (most VCs have a fund life of 10 years), as noted in a report by KfW, Germany’s state-owned development bank. KfW further notes that the total VC funding as a percentage of GDP in the U.S. of 0.211% is over 7x higher than the European Union at 0.028%. Hence, the average VC-backed U.S. startup is over 5x more funded than its European counterpart.

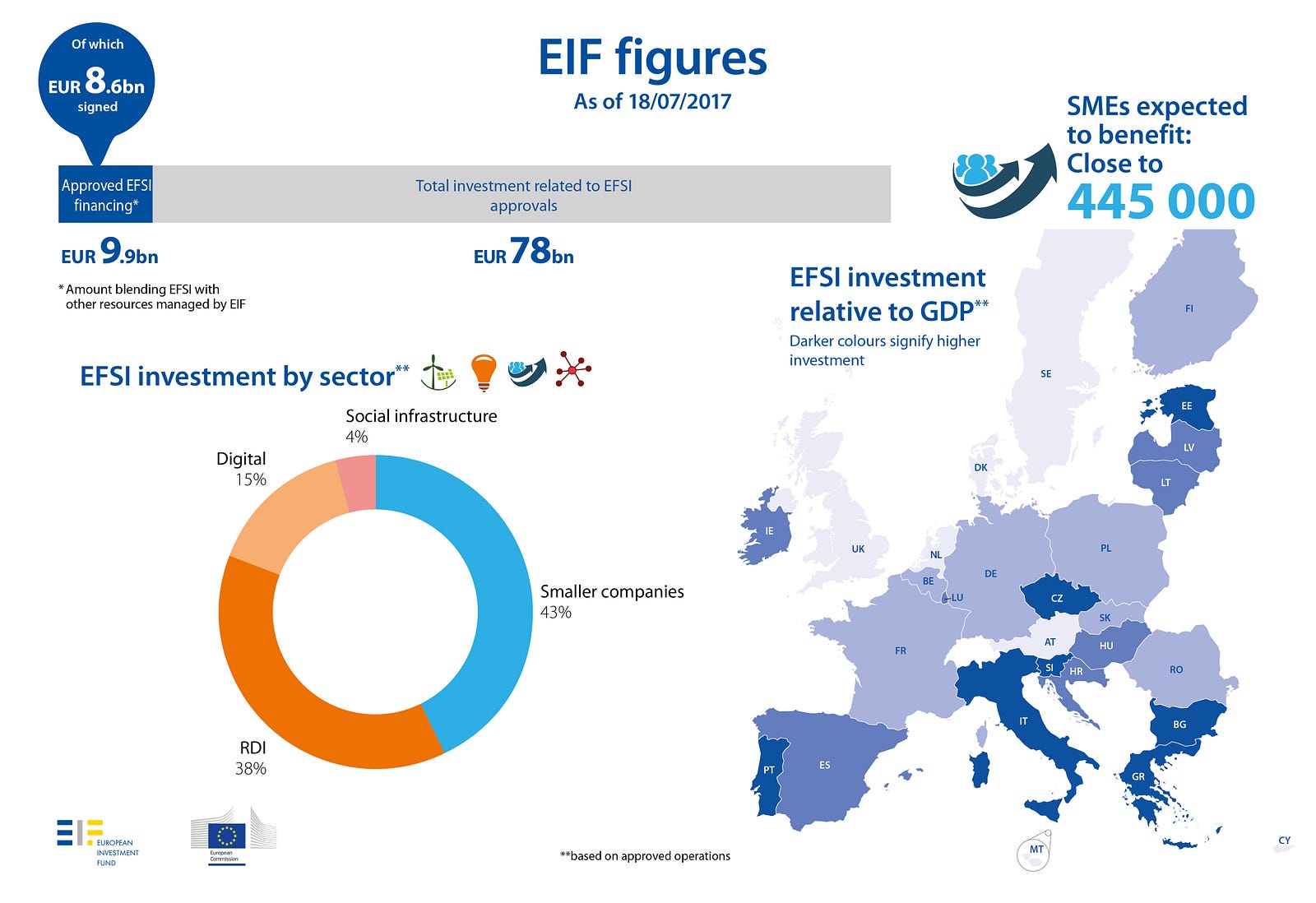

But clearly, the wind of change is blowing through Europe and the slumbering giant has awakened. By 2014, as the European Investment Fund (EIF) celebrated its 20th anniversary, it had already backed 355 VCs, which subsequently invested in 2,951 startups. Still, they intend to escalate the pace of investment. In 2015, as part of its Investment Plan for Europe, the European Investment Bank (EIB) created the European Fund for Strategic Investments (EFSI) to unlock €320B in new investments by 2018. As the European Union’s specialist provider of risk financing, the EIF was mandated by EFSI to unlock up to €75B in 3 years, of which 15% is in digital and 38% is in Research, Development and Innovation (RDI). Last year, EIF invested €3.2B (3-yr CAGR of 24.71%) across 117 funds (3-yr CAGR of 16.5%), bringing total outstanding equity commitments to €12.1B. Apart from investing in VCs, EIF is also trying to build other segments of the ecosystem by committing €320M to co-invest with business angels and €400M for capital matching with funds-of-funds.

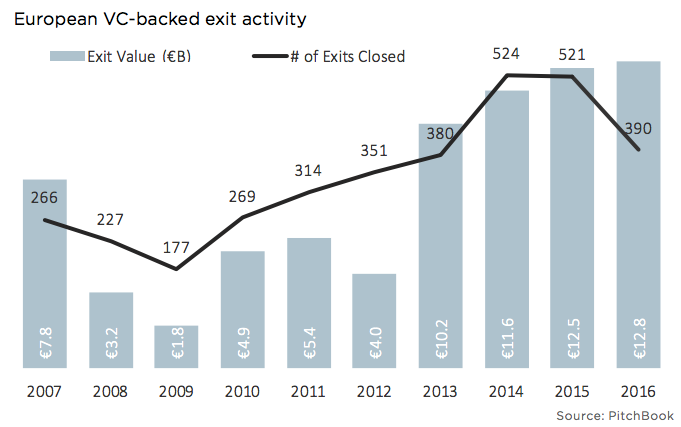

The efforts of the European Union to democratize venture funding across the continent is starting to pay dividends. The growth of exits is on a steady incline, though at a more modest pace than Asia. In 2016, the total value of exits reached a decade high of €12.8B despite a decline in number of exits. The increase was driven by the mega-exits of Acerta Pharma’s €3.6B acquisition by AstraZeneca and Sitecore’s €1B buyout by EQT Partners. Per the same Pitchbook report, another €31B of potential exits is locked away in 14 unicorns across Europe. In the last 30 days, 3 of those unicorns made headlines starting with the much anticipated IPO of the largest German unicorn Delivery Hero at a valuation of over €5B, followed by 2 Swedish fintech companies, one of which was acquired fully for €1.5B (Bambora) and the other partially in a €250M for 10% stake deal (Klarna).

One of the more important findings that may go unnoticed in the Startup Genome Report is that “European ecosystems are best at reaching a global customer base” with 20.7% of customers coming from outside the continent versus just 12.8% for all other regions. While only London and Berlin are part of the overall top 10 hubs, each of the 5 major hubs in Europe are within the top 10 in terms of global reach, led by Stockholm at 2nd. Also, of the five runners-up outside the top 20, four are in Europe, namely, Helsinki, Malta, Estonia and Lisbon. Overall, 9 out of the top 25 hubs in terms of global reach are in Europe, beating out the U.S. with just 7.

Another major driver of change is the current political climate in the U.S. It can be argued that the tech revolution in the U.S. over the last century was driven by its open culture, attracting talent from all over the world. A recent study noted that immigrants account for 25% of entrepreneurs, compose 31% of founders at VC-backed startups and are represented in at least 51% of billion dollar startups. This is expected to change with the current regime’s recent announcement that it plans to overhaul the H-1B Visa, which is held by a substantial number of the country’s top engineering talent. Regardless of how the VISA situation plays out, the message of hostility to immigrants has reverberated globally.

Meanwhile in Europe, the startup ecosystem is more robust and outward-looking than ever, despite its own version of political upheaval in the form of Brexit. If anything, continental Europe should benefit from any fallout in the UK. Within several months of the EU referendum, 20% of UK startups were already considering establishing a European outpost. Germany is an early favorite with five London-based startups having relocated to Berlin and another 39 seriously considering it as early as Nov 2016. The lower costs of living in Berlin is a huge advantage with its average monthly rental rates of €600 being less than one-third of London and Silicon Valley, and even one-fourth of New York.

Ultimately, London remains the 3rd ranked startup hub globally, trailing only Silicon Valley and New York, as of end 2016. Not far behind, Berlin and Paris are making a strong push to become global talent hubs having the 2 highest VISA success rates in the top 20 hubs, with 77% and 69% respectively, according to the Startup Genome report.

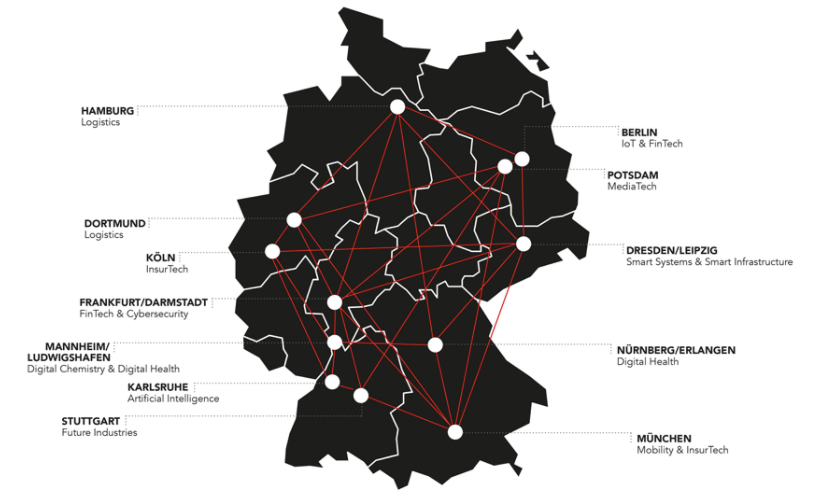

In November 2016, Germany launched de:hub, the Digital Hub Initiative, to turn 12 German cities into innovation hubs with sectoral expertise such as IoT for Berlin, FinTech for Frankfurt, Logistics for Hamburg, Mobility for Munich and Digital Health for Nürnberg. In a way, it is trying to one-up (or eleven-up) Silicon Valley by creating multiple hubs that are all inter-connected. With an economy propped up by the Mittelstand, of which there are numerous ‘hidden champions,’ Germany is trying to create a bridge to the future by adding new data to old technology.

Not to be outdone, France announced that it has created a tech VISA to attract top talent globally in March 2017. A few months later, Station F was launched in Paris as the largest startup campus in the world, which received 2,300 applicants from over 50 different countries. Since then, they have narrowed it down to 200 startups, who will get to choose from 26 different programs that they can access for free for up to one year.

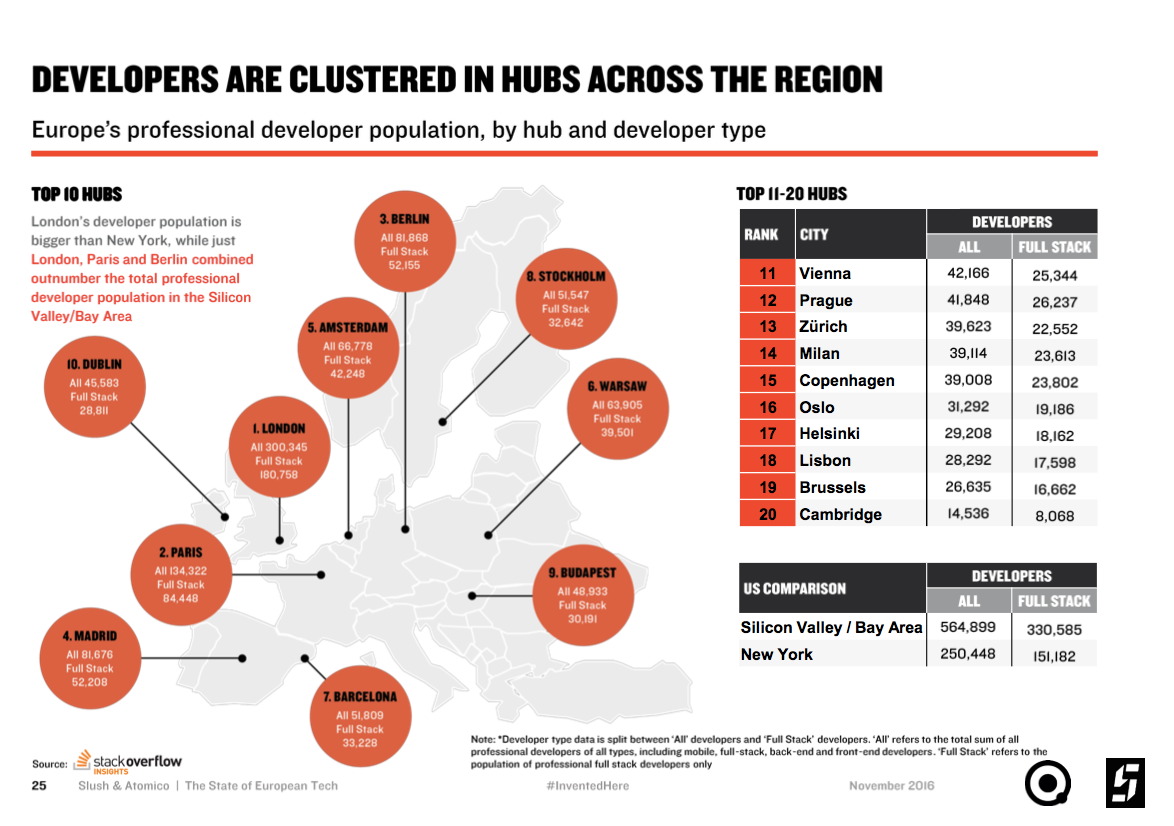

Talent and migration aside, Europe’s homegrown talent is already comparable to that of the U.S. In fact, there are now 4.7M developers in Europe versus just 4.1M in the U.S., according to Atomico’s State of European Tech 2016 report. In the same report, Atomico noted that there are now 153 unique hubs with greater than 50 tech-related Meetups per year versus only 19 in 2011. Further, the percentage of tech-related Meetups outside the top 20 hubs has increased from 23% to 49% over the last 5 years. This broad based interest in tech should fuel the tech boom in the continent the next few years.

Hidden Champions of Digital

Over the next few months, I will continue developing the investment thesis by identifying vital sectors as I understand the European ecosystem better. One early sectoral thesis is inspired by Adyen, a European unicorn, which at $2.3B is the most valuable start-up in the Netherlands. Similar to the 2 Swedish fintech unicorns, Adyen is a hidden champion of digital, generating revenues by processing online payment transactions of larger unicorns such as Uber, Airbnb and Netflix. In 2016, it processed $90B of transactions and generated revenues of $727m, a 99% increase from prior year. Yet, Adyen has little brand recall because they work behind the scenes. Across Europe, there are many more of these hidden-champions-in-the-making.

The most critical part of this cross border strategy is drawing the connection between the European success story of Adyen to an Asian success story in the form of Philippine-based virtual assistant company TaskUs. As a startup itself in 2008, TaskUs grew by creating a valuable and cost effective solution for larger startups in the U.S. It now counts fellow startups Tinder, Hootsuite, Periscope, and Eventbrite as some of its large U.S. customers. In 2016, TaskUs signed 13 new clients with $1B in aggregate value and served its customers via 7,000 employees across 3 locations in the Philippines. In this country alone, there are numerous other cross border startups that focus on various tasks such as game development (Indigo), digital marketing (Sophi), accounting (inDinero), business operations (ThumbTack), and software development (Exist).

Investing in Europe’s hidden champions of digital while simultaneously investing in SEA’s startups, which themselves might be hidden winners (if not necessarily champions) of digital, will make both of these ecosystems stronger by offering cost savings for one and revenue sources for the other. Investors straddling both continents will have front row seats and first crack opportunities to the growth of these 2 regions and how they could play off of each other.

Europe and Southeast Asia need to start talking again. Soon.

Disclaimer: The opinions expressed in this article are the author’s own and do not necessarily reflect the official opinion of the MFO that he is affiliated with.

Originally appeared on Miguel Encarnacion’s Medium post.